Irs Depreciation Life For Restaurant Equipment . Further information about which convention applies can be found on the irs website. the convention is used to determine how much depreciation can be claimed at the beginning and end of an item’s useful life when the asset is only “in service” for part of the tax year. if you haven't been taking any deductions for depreciation since the 2015 opening you will need a tax pro.you. Get detailed guidance from the. if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. 67 rows the crux of cost segregation is determining whether an asset is i.r.c. according to the irs, restaurant owners can calculate depreciation expense using the 200 percent declining. understand depreciation and fixed assets policies tailored for restaurants and bars. §1245 property (shorter cost recovery period.

from fitsmallbusiness.com

according to the irs, restaurant owners can calculate depreciation expense using the 200 percent declining. if you haven't been taking any deductions for depreciation since the 2015 opening you will need a tax pro.you. if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. 67 rows the crux of cost segregation is determining whether an asset is i.r.c. §1245 property (shorter cost recovery period. the convention is used to determine how much depreciation can be claimed at the beginning and end of an item’s useful life when the asset is only “in service” for part of the tax year. Further information about which convention applies can be found on the irs website. understand depreciation and fixed assets policies tailored for restaurants and bars. Get detailed guidance from the.

Rental Property Depreciation How It Works, How to Calculate & More

Irs Depreciation Life For Restaurant Equipment §1245 property (shorter cost recovery period. Further information about which convention applies can be found on the irs website. Get detailed guidance from the. understand depreciation and fixed assets policies tailored for restaurants and bars. if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. the convention is used to determine how much depreciation can be claimed at the beginning and end of an item’s useful life when the asset is only “in service” for part of the tax year. 67 rows the crux of cost segregation is determining whether an asset is i.r.c. §1245 property (shorter cost recovery period. according to the irs, restaurant owners can calculate depreciation expense using the 200 percent declining. if you haven't been taking any deductions for depreciation since the 2015 opening you will need a tax pro.you.

From noemystacey.blogspot.com

Restaurant equipment depreciation calculator NoemyStacey Irs Depreciation Life For Restaurant Equipment if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. if you haven't been taking any deductions for depreciation since the 2015 opening you will need a tax pro.you. Further information about which convention applies can be found on the irs website. according to the irs,. Irs Depreciation Life For Restaurant Equipment.

From awesomehome.co

Irs Depreciation Tables In Excel Awesome Home Irs Depreciation Life For Restaurant Equipment 67 rows the crux of cost segregation is determining whether an asset is i.r.c. if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. Get detailed guidance from the. Further information about which convention applies can be found on the irs website. if you haven't been. Irs Depreciation Life For Restaurant Equipment.

From dxosxpcdi.blob.core.windows.net

How To Calculate Depreciation On Business Equipment at Mary Hampton blog Irs Depreciation Life For Restaurant Equipment understand depreciation and fixed assets policies tailored for restaurants and bars. according to the irs, restaurant owners can calculate depreciation expense using the 200 percent declining. §1245 property (shorter cost recovery period. 67 rows the crux of cost segregation is determining whether an asset is i.r.c. if you figured depreciation using the maximum expected useful life. Irs Depreciation Life For Restaurant Equipment.

From dxorzcdfs.blob.core.windows.net

Useful Life Of Equipment For Depreciation at Stephen Curtis blog Irs Depreciation Life For Restaurant Equipment according to the irs, restaurant owners can calculate depreciation expense using the 200 percent declining. understand depreciation and fixed assets policies tailored for restaurants and bars. Get detailed guidance from the. if you haven't been taking any deductions for depreciation since the 2015 opening you will need a tax pro.you. 67 rows the crux of cost. Irs Depreciation Life For Restaurant Equipment.

From exoakoyfo.blob.core.windows.net

Macrs Depreciation Lives at Kim Lake blog Irs Depreciation Life For Restaurant Equipment 67 rows the crux of cost segregation is determining whether an asset is i.r.c. if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. Further information about which convention applies can be found on the irs website. according to the irs, restaurant owners can calculate depreciation. Irs Depreciation Life For Restaurant Equipment.

From exojbdncg.blob.core.windows.net

Depreciable Life For Machinery And Equipment at Rhonda McClain blog Irs Depreciation Life For Restaurant Equipment §1245 property (shorter cost recovery period. Further information about which convention applies can be found on the irs website. Get detailed guidance from the. understand depreciation and fixed assets policies tailored for restaurants and bars. according to the irs, restaurant owners can calculate depreciation expense using the 200 percent declining. the convention is used to determine how. Irs Depreciation Life For Restaurant Equipment.

From willsanellis.blogspot.com

Heavy equipment depreciation calculator WillsanEllis Irs Depreciation Life For Restaurant Equipment Get detailed guidance from the. if you haven't been taking any deductions for depreciation since the 2015 opening you will need a tax pro.you. the convention is used to determine how much depreciation can be claimed at the beginning and end of an item’s useful life when the asset is only “in service” for part of the tax. Irs Depreciation Life For Restaurant Equipment.

From www.chegg.com

Solved The depreciation schedule for certain equipment has Irs Depreciation Life For Restaurant Equipment if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. according to the irs, restaurant owners can calculate depreciation expense using the 200 percent declining. Get detailed guidance from the. the convention is used to determine how much depreciation can be claimed at the beginning and. Irs Depreciation Life For Restaurant Equipment.

From dxozijynq.blob.core.windows.net

Equipment Depreciation Life Macrs at Stephen Connelly blog Irs Depreciation Life For Restaurant Equipment Get detailed guidance from the. according to the irs, restaurant owners can calculate depreciation expense using the 200 percent declining. if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. 67 rows the crux of cost segregation is determining whether an asset is i.r.c. the. Irs Depreciation Life For Restaurant Equipment.

From cabinet.matttroy.net

Irs Depreciation Tables Matttroy Irs Depreciation Life For Restaurant Equipment if you haven't been taking any deductions for depreciation since the 2015 opening you will need a tax pro.you. the convention is used to determine how much depreciation can be claimed at the beginning and end of an item’s useful life when the asset is only “in service” for part of the tax year. understand depreciation and. Irs Depreciation Life For Restaurant Equipment.

From www.commo.com.au

Depreciation deductions in a restaurant BMT Commo. Irs Depreciation Life For Restaurant Equipment Further information about which convention applies can be found on the irs website. §1245 property (shorter cost recovery period. the convention is used to determine how much depreciation can be claimed at the beginning and end of an item’s useful life when the asset is only “in service” for part of the tax year. if you figured depreciation. Irs Depreciation Life For Restaurant Equipment.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Irs Depreciation Life For Restaurant Equipment understand depreciation and fixed assets policies tailored for restaurants and bars. §1245 property (shorter cost recovery period. if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. the convention is used to determine how much depreciation can be claimed at the beginning and end of an. Irs Depreciation Life For Restaurant Equipment.

From www.sampleschedule.com

27+ Sample Depreciation Schedule sample schedule Irs Depreciation Life For Restaurant Equipment 67 rows the crux of cost segregation is determining whether an asset is i.r.c. Further information about which convention applies can be found on the irs website. understand depreciation and fixed assets policies tailored for restaurants and bars. §1245 property (shorter cost recovery period. Get detailed guidance from the. the convention is used to determine how much. Irs Depreciation Life For Restaurant Equipment.

From fitsmallbusiness.com

Rental Property Depreciation How It Works, How to Calculate & More Irs Depreciation Life For Restaurant Equipment understand depreciation and fixed assets policies tailored for restaurants and bars. 67 rows the crux of cost segregation is determining whether an asset is i.r.c. if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. the convention is used to determine how much depreciation can. Irs Depreciation Life For Restaurant Equipment.

From www.irs.gov

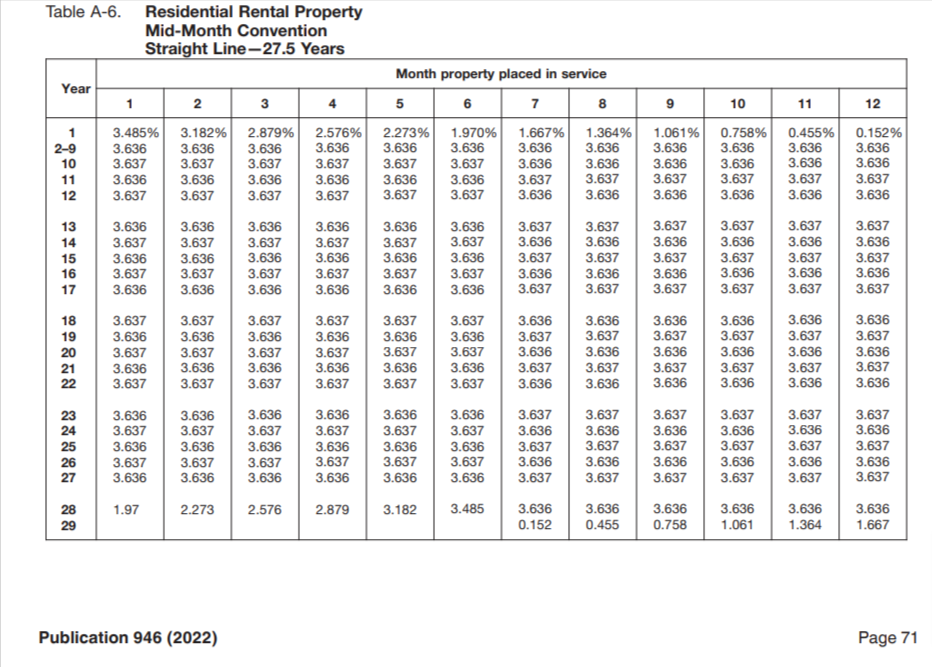

Publication 946 (2023), How To Depreciate Property Internal Revenue Service Irs Depreciation Life For Restaurant Equipment Get detailed guidance from the. according to the irs, restaurant owners can calculate depreciation expense using the 200 percent declining. Further information about which convention applies can be found on the irs website. 67 rows the crux of cost segregation is determining whether an asset is i.r.c. understand depreciation and fixed assets policies tailored for restaurants and. Irs Depreciation Life For Restaurant Equipment.

From cabinet.matttroy.net

Irs Depreciation Tables In Excel Matttroy Irs Depreciation Life For Restaurant Equipment if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. if you haven't been taking any deductions for depreciation since the 2015 opening you will need a tax pro.you. the convention is used to determine how much depreciation can be claimed at the beginning and end. Irs Depreciation Life For Restaurant Equipment.

From www.goldenappleagencyinc.com

Restauranteur's Guide to Kitchen Equipment Depreciation Rate Irs Depreciation Life For Restaurant Equipment if you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you. if you haven't been taking any deductions for depreciation since the 2015 opening you will need a tax pro.you. according to the irs, restaurant owners can calculate depreciation expense using the 200 percent declining. understand. Irs Depreciation Life For Restaurant Equipment.

From dxorzcdfs.blob.core.windows.net

Useful Life Of Equipment For Depreciation at Stephen Curtis blog Irs Depreciation Life For Restaurant Equipment the convention is used to determine how much depreciation can be claimed at the beginning and end of an item’s useful life when the asset is only “in service” for part of the tax year. Get detailed guidance from the. if you figured depreciation using the maximum expected useful life of the longest lived item of property in. Irs Depreciation Life For Restaurant Equipment.